E-Invoicing Mandate: The New Norm for Government

Electronic invoicing has become a requirement for government agencies due to the digitization of society.

The mandate for e-invoicing entails that both government organizations and their suppliers must use electronic invoices for their financial transactions. This obligation aims to enhance efficiency, reduce costs, and improve transparency in financial processes.

E-Invoicing for Governments: The Benefits of Digitalization

E-invoicing for a government offers numerous advantages for government agencies but also their partners:

- Efficiency: E-invoicing significantly reduces invoice processing time. Manual tasks like data entry and paper documents are automated, resulting in faster payments and more efficient workflows.

- Accuracy: E-invoices eliminate errors often associated with manual data entry. This reduces disputes and enhances the reliability of financial data.

- Transparency: E-invoices provide a structured and standardized format, making it easier to share and analyze financial information. This contributes to greater transparency in financial transactions.

E-Invoicing for the Dutch Government: Leading the Way in Digitalization

Within the Dutch Government, the obligation of e-invoicing is pursued with ambition. The Dutch Government serves as an example of digital transformation and encourages suppliers to submit e-invoices through the e-invoice portal. By taking the lead in this digital shift, the Dutch Government reinforces its role as a modern and efficient government institution.

The Importance of the E-Invoice Portal: A Gateway to Efficiency

The e-invoicing portal plays a crucial role in promoting e-invoicing within the government. This platform provides a standardized environment where suppliers can submit, manage, and track their electronic invoices. The e-invoice portal facilitates smooth interaction between government agencies and their suppliers, resulting in streamlined invoicing processes.

A Seamless Transition to E-Invoicing

To ensure a smooth transition to e-invoicing, a structured approach is required. Suppliers need to be aware of the obligation and prepare for the implementation of e-invoicing processes. This includes adjusting internal systems, understanding standardized formats, and utilizing the e-invoice portal.

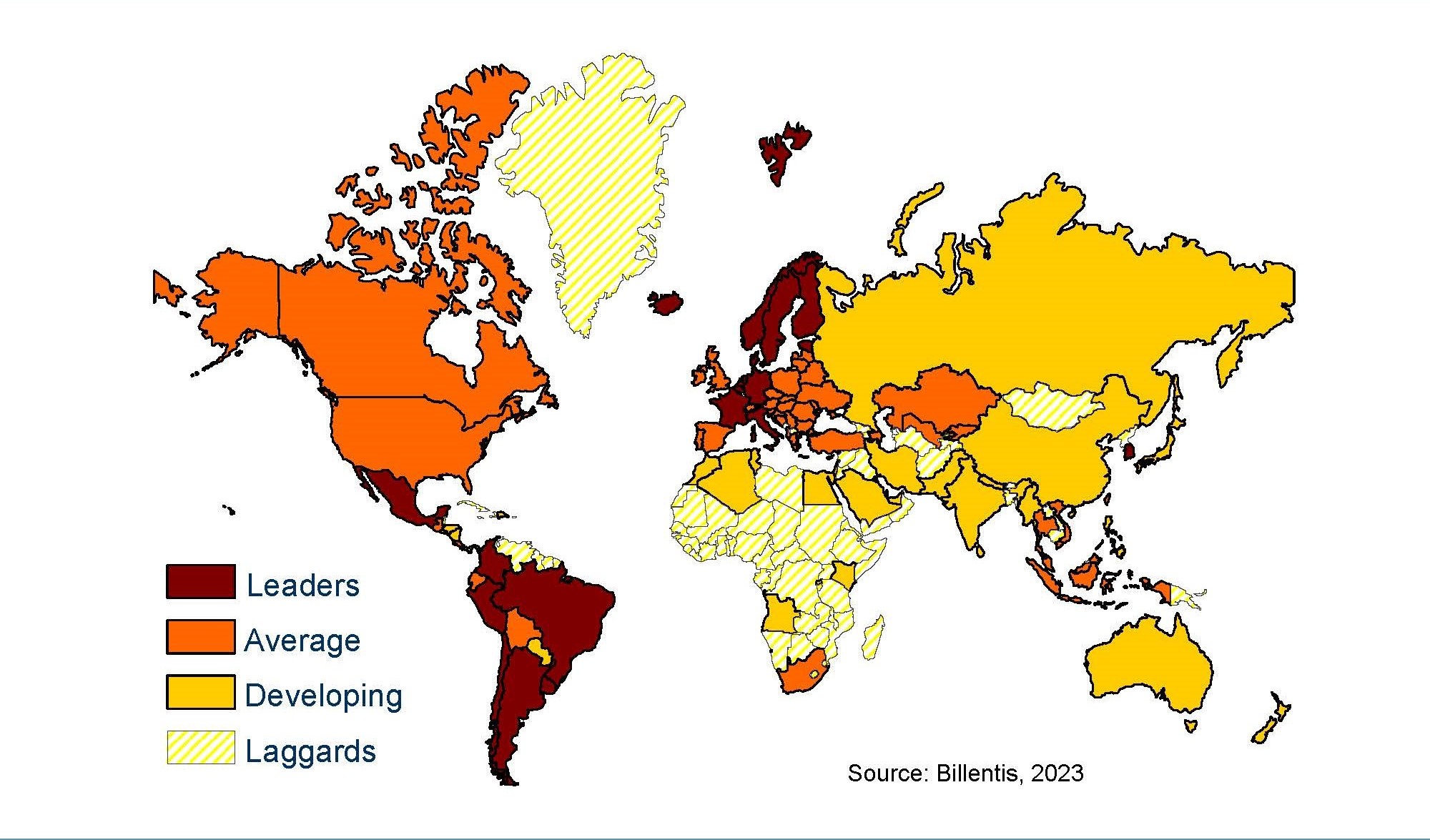

Expected E-Invoicing Status 2023: B2B, B2G, G2B, G2C

Expected E-Invoicing Status 2023: B2B, B2G, G2B, G2C

Digitally issued by suppliers & received by buyers

SPS Commerce (formerly known as TIE Kinetix): The Partner for E-Invoicing

SPS Commerce (formerly known as TIE Kinetix), a leading expert in the field of e-invoicing, is ready to support government agencies and suppliers with digital invoicing. With in-depth expertise and advanced technologies, SPS Commerce offers solutions that seamlessly integrate with existing systems and assist in meeting the mandatory requirements.

A Future of Efficiency and Transparency

E-invoicing for the government represents the future of efficient, transparent, and modern financial processes. By promoting digital innovation and utilizing technologies like the e-invoice portal, the government has become a pioneer in transforming financial transactions.