Breukelen, the Netherlands – February 2, 2022 at 8 AM CET – TIE Kinetix, a leader in 100% supply chain digitalization, announced its trading update for the first quarter of financial year 2022 today.

100% SaaS Business

Effective October 1, 2021 (the start of the Company’s first quarter) management has decided to direct the Company’s business model entirely to the delivery and use of its SaaS solutions, in order to support the positioning of the Company as a 100% SaaS company with a focus on long term subscription contracts and annual recurring revenue. The Company is stepping up its expenditure and investments in marketing, sales and onboarding to lay the foundation for further growth in all of its markets. Such increased expenditure is visible in increasing staff levels, recruitment costs, marketing costs etc.

Following the 100% focus on SaaS delivery, the Company has revisited its consultancy activities to prioritize activities that support SaaS growth. As a result, the Company will reclassify certain activities previously reported under consultancy revenue to (future) SaaS revenue. The reclassification is a presentation matter where revenue (and costs) of certain consultancy activities are presented under SaaS. As a result revenues are recognized over 36 months in SaaS revenue (and costs amortized accordingly). This time allocation does not lead to lower or different revenue/margins over the life of the contract. To illustrate this effect, out of € 1,224k invoiced to customers on active consultancy projects in Q1 2022 (Q1 2021: € 930k), an amount of € 748k shall be allocated to SaaS revenue (Q1 2021: € 82k).

Interim dividend of € 0.50 per share and future dividends

The Company will seek shareholder approval to initiate a dividend policy as from financial year 2022 (starting October 1, 2021). The Company strives for a stable dividend payout, with the aim of distributing at least 40% of net profit. We aim to grow the dividend payment percentage to the 50% level in the coming years. Management considers that such a dividend policy is backed by the very high share (80%+) of recurring business in its business model. Shareholders may elect to receive the dividend either in cash (net of 15% withholding tax) or in TIE Kinetix shares (without withholding taxes). If a shareholder makes no election the dividend will be paid out in TIE Kinetix shares.

To underscore management’s confidence in the growth strategy the Company opts to distribute the 2022 interim dividend from its reserves, in the absence of sufficient net profit. Should a similar situation prevail in the near future, the Company may opt for a similar dividend distribution from its reserves. With a dividend distribution from its reserves, TIE Kinetix effectively distributes part of the proceeds realized with the divestment of its non-strategic operations during financial year 2020. The optional dividend enables TIE Kinetix to realize a higher pay-out while maintaining a strong balance sheet for the roll-out of its strategy and possible acquisitions. This is a good fit with, and expresses management’s confidence in, our growth strategy.

The Executive Board proposes to initiate its dividend policy with an 2022 interim dividend of € 0.50 per share subject to AGM approval in March 2022. This will imply a maximum cash outflow of € 840k when all shareholders elect cash dividend.

Future dividend distributions will only be made to the extent that the Company can maintain a consolidated equity position at least equal to the net book value of its tangible and intangible fixed assets, while assuring sufficient group cash levels to counter working capital volatility. Our dividend return and the type of dividend we payout are competitive compared to other listed companies.

Capital markets day

The Company will host a Capital Markets Day on March 2, 2022. During this digital event - organized by Investor Relations Advisory firm Edison - management will update (potential) investors in TIE Kinetix shares on key strategic developments in our markets. Participation in this event is unrestricted and open to all those interested.

Key figures

Financial highlights

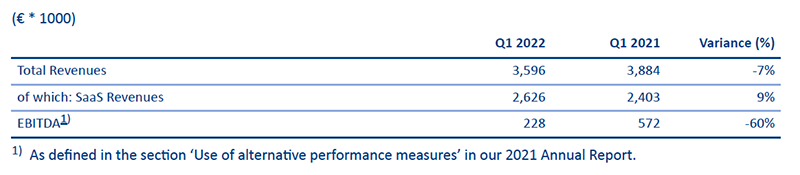

- Q1 Order intake at a solid level of € 2,823k, compared to € 1,974k in Q1 2021 (increase of 43%);

- SaaS revenue growth on plan from € 2,403k (Q1 2021) to € 2,626k (increase of 9%);

- Total revenue down from € 3,884k (Q1 2021) to € 3,596k (decrease of 7%), following strategic changes impacting the consultancy activities and revenue recognition thereof - refer to heading ’100% SaaS business’ on previous page;

- EBITDA down from € 572k (Q1 2021) to € 228k (decrease of 60%), following lower revenue and increased expenditures - refer to heading ’100% SaaS business’ on previous page.

Message from Jan Sundelin, CEO

With the first quarter of financial year 2022 behind us, we can say that it has set the tone for the transformative year that we had planned for the Company. As of 1 October 2021 we went live with our customer success teams, which are responsible for driving the successful deployment of FLOW at customers, maintaining and growing client relationships. This frees up our our sales teams to focus on acquiring new customers. In that respect, we have been able to expand our reach in the business-to-government market in Germany significantly with our new customer Da-Di-Werk.

Paired with increases in our marketing expenditure (which had been at minimal levels since the start of the pandemic), the first successes of our new sales focus are materializing with the increased order intake compared to the first quarter of last year. The expansion of our organization is reflected in our staff levels and deployment of external resources for support and onboarding.

As from 1 October 2021, we have taken further steps to prioritize consultancy activities that support SaaS-growth. This means that our portfolio of consultancy projects, and the way we manage our business, has changed.

It is important to acknowledge that all these developments are supportive of one thing: future SaaS-revenue growth for FLOW. Over the past quarter we have proven once again that this is a best-in-class product, now being ISO 27017 and ISO 27018 certified to provide our customers a high level of assurance on information security and privacy.

Financial calendar

Notice

This trading update is unaudited. All figures in this trading update are stated in thousands of euro, unless indicated otherwise.

Cautionary statement regarding forward-looking information

This document may contain expectations about the financial state of affairs and results of the activities of TIE Kinetix as well as certain related plans and objectives, and may be expressed in a variety of ways, such as ‘expects’, ‘projects’, ‘anticipates’, ‘intends’ or similar words. TIE Kinetix has based these forward-looking statements on its current expectations and projections about future events. Such expectations for the future are naturally associated with risks and uncertainties because they relate to future events, and as such depend on certain circumstances that may not arise in future. Various factors may cause real results and developments to deviate considerably from explicitly or implicitly made statements about future expectations. Such factors may for instance be changes in expenditure by companies in important markets, in statutory changes and changes in financial markets, in the salary levels of employees, in future borrowing costs, in future take-overs or divestitures and the pace of technological developments. TIE Kinetix therefore cannot guarantee that the expectations will be realized. TIE Kinetix also refuses to accept any obligation to update statements made in this document.

You can download the PDF version of the report here.

About TIE Kinetix

At TIE Kinetix, we help companies of all sizes achieve their digitalization goals. From 1% to 100% or anywhere in between, our cloud-native FLOW Partner Automation platform is designed to completely eliminate paper from the supply chain, enabling our customers to focus on three corporate initiatives that drive true organizational change: business process efficiency, compliance, and corporate social responsibility (CSR).

We believe that digitalization (not digitization) is the future. We believe in conscious development, and we believe in moving ourselves and our customers forward. More than 2,500 companies have chosen TIE Kinetix to support their EDI, e-invoicing, and general digitalization projects, and we proudly facilitate the exchange of over 1 billion documents through FLOW each year—the equivalent of 10,000 trees saved.

Founded in 1987, TIE Kinetix is a public company (Euronext: TIE) with offices in the Netherlands (HQ), France, Germany, Australia, and the United States. For more information, visit www.TIEKinetix.com, and follow us on LinkedIn, Twitter, Facebook, Xing, and YouTube.

For more information please contact:

TIE Kinetix N.V.

Michiel Wolfswinkel, CFO

De Corridor 5d

3621 ZA Breukelen

T: +31-88-369-8000 (Europe) or 1-800-624-6354 (USA)

E: Michiel.Wolfswinkel@TIEKinetix.com

W: www.TIEKinetix.com