The Changing Landscape of E-Invoicing Regulations

In an age of rapid technological progress, legislative frameworks struggle to keep up with the digital revolution. E-invoicing, once an emerging trend, has now become a global standard.

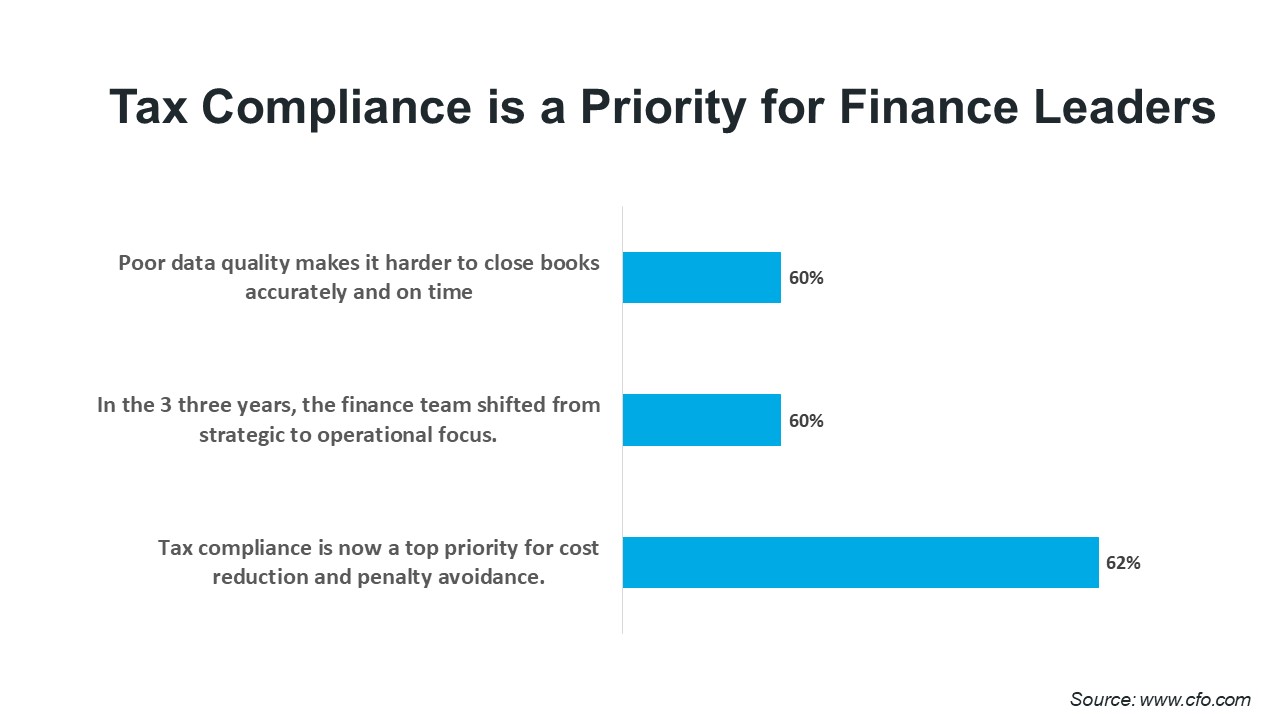

Governments and regulatory bodies are enacting laws that mandate businesses to adopt e-invoicing, aiming to streamline processes, enhance transparency, and combat tax evasion. CFOs need to take a proactive approach to compliance to navigate the constantly changing business environment.

The Complexity of Cross-Border Transactions

Cross-border businesses face additional challenges with e-invoicing legislation. Different countries have diverse regulations, formats, and requirements. Navigating this complex web requires knowledge of local regulations while keeping a global viewpoint. CFOs must ensure that their e-invoicing solutions can seamlessly adapt to the complexities of various jurisdictions.

Compliance as a Strategic Advantage

Compliance isn’t just a matter of ticking boxes; it’s a strategic advantage. Organizations that proactively adhere to e-invoicing legislation position themselves as trustworthy and transparent partners. Compliance also offers operational benefits—swift and accurate invoice processing, reduced risk of penalties, and streamlined audits. By embracing compliance, CFOs enhance their organization’s reputation and efficiency.

SPS Commerce (formerly known as TIE Kinetix): The Beacon of Compliance

When dealing with numerous legislative changes, it becomes vital to partner with an expert. SPS Commerce, a pioneer in e-invoicing solutions, empowers CFOs with the tools to stay ahead of e-invoicing legislation. Their solutions are designed with a deep understanding of global regulations, ensuring seamless compliance across diverse jurisdictions.

A Closer Look at Compliance Essentials

- EESPA and Peppol Participation: Active involvement in organizations such as EESPA (European E-Invoicing Service Providers Association) and Peppol (Pan-European Public Procurement Online) signifies dedication to industry standards. The engagement of SPS Commerce (formerly known as TIE Kinetix) with these organizations ensures that their solutions align 100% with evolving regulations.

- Expertise in Local Regulations: E-invoicing legislation varies from country to country. The solutions of SPS Commerce are tailored to address local regulations, ensuring that CFOs can confidently navigate the complexities of cross-border transactions.

- Compliance Monitoring: The laws regarding e-invoicing are constantly changing. SPS Commerce closely monitors regulatory changes, keeping its solutions updated to reflect the latest requirements. CFOs can be reassured that their electronic invoicing processes are fully compliant.

- Integration with Government Platforms: In countries where governments provide e-invoicing platforms, seamless integration is crucial. SPS Commerce’s solutions facilitate direct integration with these platforms, simplifying compliance and enhancing efficiency.

Embracing Compliance as a Business Enabler

While e-invoicing legislation presents challenges, it also offers opportunities for strategic transformation. CFOs can leverage compliance initiatives to drive operational efficiency, enhance relationships with partners, and position their organization as a beacon of transparency. Compliance-driven e-invoicing also prepares businesses for the future, as governments worldwide continue to enforce e-invoicing mandates.

The Path to Move Forward: Navigating with Confidence

In conclusion, to navigate the continuously changing e-invoicing legislation, a proactive and strategic approach is required. CFOs can confidently navigate this terrain with expert partners like SPS Commerce (formerly TIE Kinetix). Adherence to compliance is essential to drive organizations toward excellence.

With a deep understanding of local regulations, active engagement in industry bodies, and solutions designed to align with evolving requirements, SPS Commerce empowers CFOs to navigate e-invoicing legislation with confidence and foresight.

The legislation surrounding e-invoicing is constantly evolving, allowing CFOs to uphold compliance and improve operational efficiency. By embracing compliance as a business enabler, CFOs position their organizations as frontrunners in the digital transformation of financial operations.